BLOG

5 employment law changes you need to know about in April 2021

April tends to be a busy month for employment law. While there’s no Good Work Plan to grapple with this time around, there are certain changes coming into play next month that employers will need to take note of.

1 April: National Minimum Wage increases

Statutory rates are reviewed and updated each April. From 1 April 2021, the National Living Wage will increase 2.2%, from £8.72 to £8.91 an hour.

The National Living Wage normally applies to workers aged 25 and over (excluding those in the first year of an apprenticeship). However, this year, Chancellor Rishi Sunak announced that it will be extended to 23 and 24-year-olds for the first time, representing a substantial pay rise of almost 9%.

National Minimum Wage rates for those under the age of 25 will also increase as follows:

- Workers aged 21 to 22: £8.36 (up 2% from £8.20)

- Workers aged 18 to 20: £6.56 (up 1.7% from £6.45)

- Workers aged 16 to 17: £4.62 (up 1.5% from £4.55)

- Apprentices: £4.30 (up 3.6% from £4.15)

Remember, apprentices aged 19 or over who have completed their first year must be paid at least the minimum wage rate for their age.

In theory, adjusting to minimum wage changes should be relatively straightforward, but it does require a bit of leg work. Make sure to review your organisation’s pay rates against the 2021 rates, notify workers of any pay increase and update your payroll accordingly.

In December 2020, the government named and shamed 139 companies, including major household names, who short-changed their employees. As well as HMRC fines, failing to pay workers correctly may leave the door open to Employment Tribunal claims, so it’s important to get this right.

Make sure you have a system in place to revisit employees’ pay after birthdays, as they may move into a different National Minimum Wage bracket.

Do you need support?

Speak to us for an honest, no obligation chat on:

0345 226 8393 Lines are open 9am – 5pm

4 April: Other rates of pay increase, including maternity pay

The government’s new rates and thresholds for 2021/22 also change the amount of other types of pay employees are entitled to.

From 4 April 2021, rates of Statutory Maternity Pay, Statutory Paternity Pay, Statutory Adoption Pay, Statutory Shared Parental Pay and Statutory Parental Bereavement Pay will increase to from £151.20 to £151.97 (or 90% of an employee’s average weekly earnings, whichever is lower).

The Statutory Sick Pay (SSP) standard rate will also increase from 6 April 2021 to £96.35 per week.

While this rate applies to all employees, the actual amount you must pay an employee for each day of sickness absence (the daily rate) will depends on the number of ‘qualifying days’ they work each week. The government’s SSP calculator will help you to work out how much SSP employees are entitled to.

All of these statutory pay changes will need to be reflected in your payroll and any information regarding the expenses and benefits you provide to employees.

4 April: Gender pay gap reporting (now extended until October)

Each year, employers with 250 or more employees are legally required to report on the difference in earnings between men and women. This exercise helps organisations to understand the size and causes of pay disparity and provides HR with insight it can use to identify strategies which will narrow the gap.

Most public authority employers were originally expected to publish their gender pay gap information by 30 March 2021, and private, voluntary, and all other public authority employers by 4 April 2021. However, due to the ongoing complications caused by coronavirus, employers have been given a six-month reprieve, with the deadline now extended until 5 October for all employers.

While the Equality and Human Rights Commission (EHRC) has confirmed that it will not begin enforcement proceedings before 5 October, it has urged companies to report by the April deadline if possible. If this is something you would rather tick off your list now, you can do so here.

This is the second year in a row that the government has sacrificed gender pay reporting due to coronavirus. While the Minister for Women and Equalities, Liz Truss, conceded last year that it was “only right” to suspend gender pay reporting due to the pressures on business, the women and equalities select committee has now expressed concerns that the pandemic has “risked further entrenching inequalities between women and men” and has called for gender pay reporting to be urgently reinstated, so watch this space.

6 April: The introduction of IR35

IR35 off-payroll working rules will come into effect on 6 April 2021.

This ‘anti-avoidance tax legislation’ is designed to ensure those who are employed in all but name are taxed at a rate similar to employed individuals. This will effectively shift the burden onto employers to prove that workers are in fact self-employed.

In addition to checking employees’ tax status, it will also be necessary to conduct a separate assessment of an individual’s employment law status to confirm that they are correctly classified – an issue that has resurfaced recently due to the long-awaited Uber decision (which confirmed that the company’s drivers are in fact workers, not self-employed contractors). The upcoming IR35 changes will shine the spotlight on employment status once more.

It can be notoriously difficult to work out whether someone is an employee or a worker. Ultimately, both Employment Tribunals and HMRC can make decisions about employment status, but they can reach different conclusions. Crucially to IR35, it is perfectly possible for someone to be classified as one thing for tax purposes and another for the purpose of key employment law rights. It is therefore important to consider both aspects.

30 April: Furlough (now extended until the end of September)

One major change that businesses were bracing for was the end of the furlough scheme on 31 April. However – somewhat predictably given that many business will be unable to reopen before 21 June as part of the government’s four-stage plan – Chancellor Rishi Sunak confirmed in the Budget announcement on 3 March that the scheme will be extended yet again until the end of September.

Employees will continue to be entitled to receive 80% of their wages (subject to a cap of £2,500 per month) and may be continuously furloughed or placed on flexible furlough (allowing them to work part of their normal hours as things gradually open up).

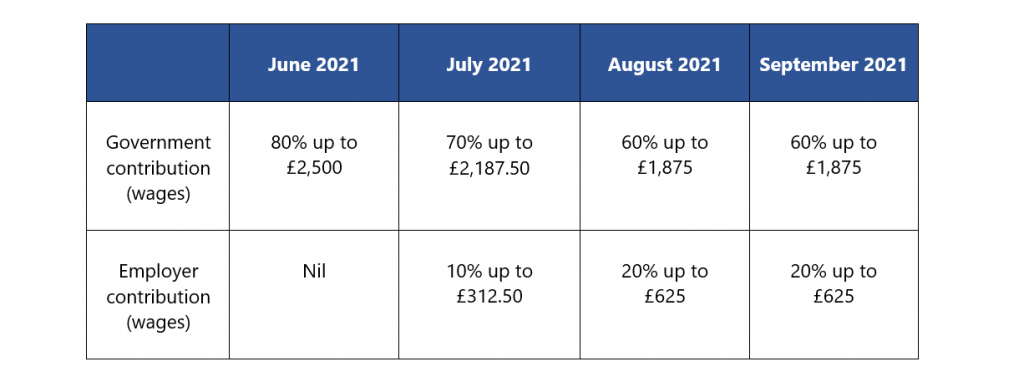

Until July, nothing will change. There will be no employer contribution to wages, other than employer National Insurance contributions and minimum auto-enrolment pension contributions (typically amounting to 5% of employment costs). However, those still using the scheme from July onwards will have to contribute 10% towards furlough wages (with the government covering the remaining 70%), increasing to 20% in August and September (with the government covering 60%). The table below shows a month-by-month breakdown of the source of furlough contributions.

Having scrapped the Job Retention Bonus – a one-off payment to employers of £1,000 for each furloughed employee kept on until 31 January – the government had promised an alternative retention incentive. However, there was no mention of this in the Budget and it looks unlikely that any such scheme will be forthcoming.

James Tamm, Director of Legal Services at Ellis Whittam, says the extension will be welcomed by businesses, but for some the announcement may have come too late:

“Many businesses will be grateful for the extension of the scheme until the end of September, which is beyond what most will have expected. Whether business in the hardest hit sectors will be able to afford the wage contributions in July, August and September will no doubt depend on the lockdown conditions prevalent at those times. Much will depend on a successful vaccine rollout across the entire population and a complete end to all social distancing measures.”

He continues: “Some business may have already been forced to act by cutting costs prior to the Chancellor’s announcement. Whilst it is possible for them to re-employ people they have made redundant and furlough them, that should be approached with caution. Anyone taken back on will start to accrue holidays again and will have the right to notice after one month’s service, so there will be additional costs to businesses. There are also complex rules about continuity of employment if someone is re-employed very soon after leaving. As a result, our advice generally is not to re-employ – but if you choose to, make sure you leave a two-week gap between dismissal and re-engagement.”

J B Tool Hire Ltd

Need help getting to grips with employment law changes?

At Ellis Whittam, we help businesses stay one step ahead of legal developments that may affect how they operate. From furlough announcements to statutory rate changes, with support from named Employment Law specialists, you can make sense of your obligations, adapt with minimal fuss, and prevent costly mistakes. Our fixed-fee Employment Law & HR service even includes support with reviewing and updating documentation, saving you time and making sure you’re compliant.

For straightforward advice on any of the issues mentioned in this article and to find out more about how we can help, call 0345 226 8393 or request your free consultation using the button below.

Sign up for the latest news & insights

Resources

Latest News & Insights

Hiring strategies to overcome the effects of rising unemployment in the UK

BLOG Written by Danielle Fargnoli-Read on 25 February 2026 Unemployment has crept up to its highest level in almost five years, with official figures now

Language of appreciation at work | Why individual motivation matters

BLOG Written by Becs Bridge, Director of Learning & Development, on 23 January 2026 In today’s competitive talent market, the organisations that retain top performers

Recruitment trends 2026 | 7 things to expect when hiring this year

BLOG Written by Danielle Fargnoli-Read on 22 January 2026 If there’s one thing recruitment has taught us over the past few years it is that

Breach of employment contract | What employers need to know to avoid Tribunal claims

BLOG Written on 15 January 2026 Breach of contract is a common concern for businesses, particularly during resignations, dismissals, or disputes over pay, notice, or

When does the Employment Rights Bill 2025 come into effect?

BLOG Written on 19 December 2025 It’s been the most talked-about topic in HR in 2025 and the question everyone’s been asking is, “When is

Workforce planning | Structuring your business for success

BLOG Written by Danielle Fargnoli-Read (updated 5 February 2026) Strategic workforce planning is a vital business process that’ll align your organisational needs with long-term goals.

Changes to day one unfair dismissal rights | New six-month protection explained

BLOG Written by Patrick Carroll-Fogg on 1 December 2025 Of the almost 75 individual tweaks and changes set to be introduced under the Employment Rights

Breaking down the Budget 2025 for employers

BLOG Written by Daniel Rawcliffe on 27 November 2025 The recently announced UK Budget 2025 is a challenging one for small businesses. While it covers

AI for interviews with job candidates | Balancing technology with a human touch

BLOG Written by Danielle Fargnoli-Read and Tracey Burke on 21 November 2025 Businesses using AI for interviews are reshaping the way UK businesses approach hiring,